The objective for investors is to ensure their wealth grows and is protected. In order to assure less opportunity for loss, the client will strategize with their financial counselors or wealth managers to keep the portfolio from stagnating with merely one asset class.

Diversifying with hard assets or physical commodities helps to balance the holdings, keeping the portfolio stable, disallowing the chance for a complete loss based on the financial and stock markets.

A hard asset, by definition, is a physical commodity generally held for an extended time carrying a “store of value.” The intrinsic value is measured as far as how they’re used or considering the value when they exchange.

Depending on an investor’s specific goals, these are often a wise addition to a portfolio’s holdings for those with a desire for steady returns over the long term and wealth protection.

What Are The Benefits Of Investing In Hard Assets

Hard assets boast the capacity to stabilize a portfolio with safe investments offering minimal risk and volatility compared to their counterparts. These are tangible with intrinsic value. Find a hard assets “complete” guide at https://www.indeed.com/career-advice/career-development/hard-asset/.

These don’t correlate with the financial and stock markets making them safer when there is turbulence where other assets would be vulnerable.

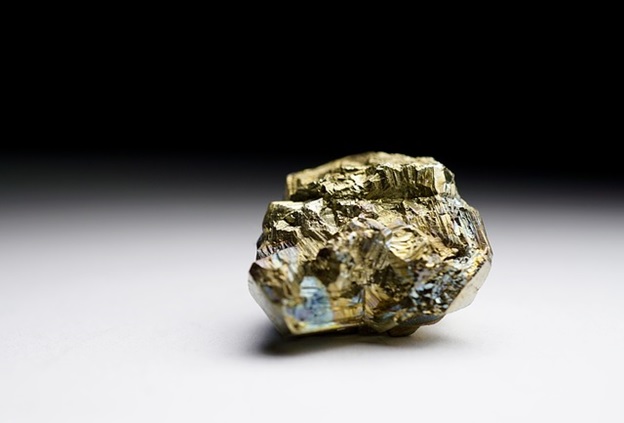

Some examples that fall under this class are precious metals like gold, real estate, collectibles, and commodities. These sorts of investments are often used to hedge against times of elevated inflation and can prove a steady resource for income.

When deciding hard assets are the option for you as an investor, it’s wise to reach out to your financial counselor or wealth manager to develop a strategy to meet your goals.

Some will be beneficial for the long-term, like precious metals and real estate, and others, like collectibles and commodities, will be better for the short term. Planning strategically with an advisor can help you gain the knowledge necessary to effectively build on your wealth as time goes by. View a 2022 investment guide on hard assets here and then look at some advantages when choosing hard assets.

● A benefit in times when there is financial turbulence

Paper assets correlate strongly with the financial and stock markets. If your portfolio is heavy on that single asset, there can be a considerable loss if the economy takes a downward spiral.

As a rule, hard assets don’t correlate with the markets but, instead, operate as a safe haven protecting wealth and diminishing the risk potential.

Gold is a favored hard asset many investors choose to diversify their portfolios, offering an extensive history of holding its value with the potential for bringing steady gains that can serve in the capacity of income with minimal risk or volatility.

● When inflation grows out of control

Hard assets play a hedge in instances when prices begin to rise. Real estate is considered a good option for investors, especially in periods when there are “inflationary pressures.”

While the suggestion is that the paper class can have exceptional volatility and risk, the hard assets are not without these. There is the potential for a decrease in the demand, plus there can be environmental and political risks.

You can mitigate these by researching and collaborating with your advisor to select the investments that suit your goals ideally.

What Are Intangible Assets

There are numerous assets, one distinction being whether these are hard or intangible; essential to designate between the two in order to meet your specific goals and accommodate your particular financial circumstances.

We’ve discussed hard assets like gold, real estate, and oil, all tangible and carrying inherent value. How these are exchanged or used will measure that value.

Intangible assets are not necessarily visible or are “non-physical,” carrying no tangible value. A hard asset will probably offer an investor a greater sense of stability with less exposure to market vulnerability, as would be true for intangible assets.

Still, each is valuable in its own sense, and investors find them attractive options for their portfolio to not only grow their wealth but act as protections in their own right. Let’s look at some intangible assets since we’ve focused on hard assets throughout.

● Intellectual property

These are often creative works with copyright imposed to protect the pieces, patents, or trademarks.

● A reference of “goodwill”

A company’s value comes from the client base it establishes and the reputation that develops through that audience. A business depends on “word-of-mouth” for steady development and growth.

If there were at some point terrible “press,” if you will, it would ruin a company’s reputation. That’s not something that can be rebuilt. Once clients receive negative feedback on an establishment, they tend not to go back regardless of efforts to improve.

● Financial securities

These are paper assets like bonds, stocks, and options. Intangible assets like these correlate with the financial and stock markets with similar fluctuations, whereas hard assets don’t have that instability; instead, they resist changes.

Final Thought

Seasoned investors work with diverse asset classes to keep their holdings balanced, preserve their wealth, allow steady growth, and protect their portfolios from heavy losses.

Most financial advisors suggest avoiding the “all eggs in one basket” you hear so much about in the investment world. Having all coinciding assets can lead to considerable loss. When you mix a blend of intangible and hard asset investments, these complement each other making the holdings more stable and disallowing the potential for vulnerability if the financial or stock markets are turbulent.

The hard assets tend to hold their value with the suggestion that they can almost act as a steady source of income, but some, like gold, are held for the long-term to gain value to use as a retirement benefit.

Suppose you’re a beginning investor with no strategy and uncertain how to develop one that will benefit you optimally. In that case, it’s wise to reach out to a financial advisor for assistance or a wealth manager. When you have a plan strategized, it’s merely a matter of selecting from the appropriate assets when the time is right.