Investing in Gold IRAs

Investing in gold IRAs has become increasingly popular over the years. Investing in gold helps to diversify your investment portfolio. It also helps to add to your investments because it does well when other investments are struggling. You must have a Gold IRA if you want to add gold to your portfolio.

Getting a Gold IRA is not much more difficult than getting a regular IRA, you just have to make sure that the company that you are working with is qualified in doing Gold IRAs. One company that can help you with this is IRA Companies Gold, they have been doing it for a while now. They can help you make the right choices for your Gold IRA.

This article will share with you the ways that you can get a Gold IRA started. It will give you some ideas of what to do and what not to do. There are many ways to invest in gold, these are just a few hints for you.

Things to Know

- Educate Yourself on Gold IRAs

You need to know the terms and concepts before you begin to invest in a Gold IRA. You need to know the different ways that you can invest such as bullion, gold funds, gold futures, gold companies, and gold mining stocks. If you know the difference between all these types of gold trading, you are on your way to success.

The first thing that you need to know is what a Gold IRA is – it is a self-directed IRA that states that you can choose what you want to invest in. It is also called a precious metals IRA because you can invest in other precious metals such as silver, platinum, and palladium.

Gold IRA investing is when you are able to use gold and other precious metals to invest in. There are requirements that you must follow such as the purity of the metal and the form in which you buy the metal. The requirements are not that difficult and can be easily done with the right company that you invest with. Make sure that you do some research to find the right company to invest with, not all are the same.

2. Start Investing in a Gold IRA

You will have to choose which kind of Gold IRA that you wish to invest in. There are two kinds, the traditional Gold IRA in which you just choose the metals that you want to invest in with pre-tax dollars. The other kind is the Roth Gold IRA in which you rollover your Roth IRA funds into the Roth Gold IRA and then invest in your metals. Both kinds are great IRAs to work with, one just may be better for you than the other.

You also need to choose a custodian for your Gold IRA, it cannot just be any company, it must be one that specializes in Gold IRAs and gold storage. There will be fees attached to opening a Gold IRA and you must familiarize yourself with them. Some custodians charge more or less fees than others do, so you want to check out more than one.

Next, you need to fund your IRA, and this can be done using a variety of ways. You could just fund a new IRA, you can rollover money from another investment fund such as a 401(k), or you can rollover from a traditional or Roth IRA. All these ways allow you to fund your account and to begin to buy the precious metals that you want in your account. There are many ways that you can do this, it all depends on what you have and what you want to do.

3.Choose the Metals for Your Gold IRA

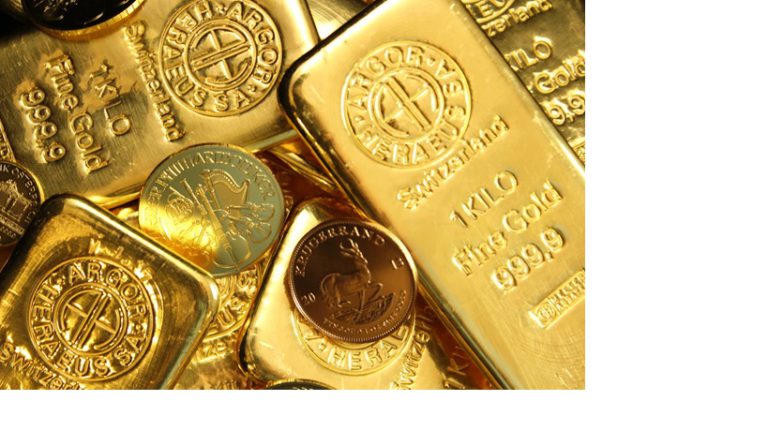

You do not have to use just gold for your gold IRA, you can use any precious metal as long as it meets the IRS requirements for purity. Many people will use a variety of metals to diversify their portfolios. The best things to invest in are bullion and coins, but you want to make sure that they fit the purity requirements which is usually 99.5% pure. You also do not want to invest in rare coins for your IRA you want to invest in common coins such as the American Eagle, the Canadian Maple Leaf, and the Australian Kangaroo. These coins have been proven to be great investments for your portfolio. You can also use bullion and bars to invest in, they are also great ways to invest.

4. Choose Direct or Indirect Ways to Own Gold

The direct way to own gold is to own the physical product in gold bars, bullion, or coins. These are items that you can physically touch and hold on to. These are ways to physically own the products that you are wanting to purchase.

The indirect way to buy gold is to buy gold futures, gold mines, or stocks in gold products. In this way you are not physically able to touch the gold, but you can still invest in it.

There might be more that you need to know about investing in Gold IRAs, but this will get you started in in. You need to do more research before you take the plunge and invest because you need to know more about investing in general. If you are new to investing, you need to investigate all you can and have a great investment broker to help you out. If you are an old hand at investing, investing in a Gold IRA can still be new to you, and you will still need to do more research.

Investing in gold is a great way for you to invest because gold is a great hedge against inflation and can be a great addition to all your other investments that might not do so well in a bad economy. Investing in gold and other precious metals can be fun, as well, because everyone wants to have a little gold in their investment portfolios.