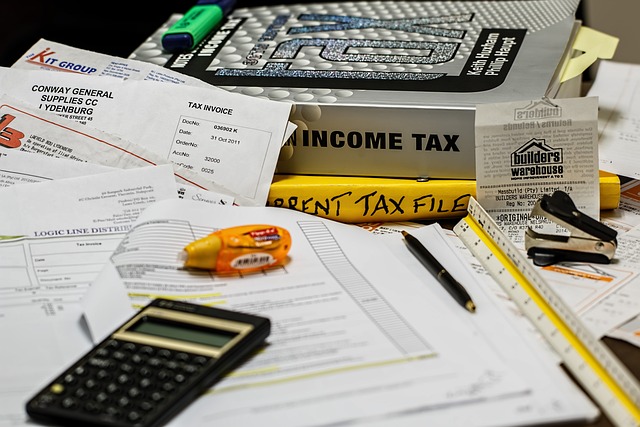

You can’t do quality business unless you’re organized about the way you get paid. Perhaps this is why invoicing is a $6.6 billion industry globally. Something as simple as a business invoice is more important than you probably realize.

The key is to learn the tips that will make your invoices accurate, timely, and professional. Your invoices will help you get paid in full and on time. The tips below will help whenever you’re creating a business invoice for your company.

Add Your Contact Info Prominently

Your invoice should have your company’s contact information fully on display. This includes the company’s name, business license number, physical and mailing address, e-mail, phone number, and any other information that you deem important.

Your customers will be better able to get in touch with you if there’s an issue, and this is an act of transparency and good faith.

Double and Triple Check the Amounts

Your math should never be wrong on your invoices. Scrutinize your amounts with a fine-toothed comb, and make sure that your prices are broken down in an itemized list, along with totals included at the bottom.

This is particularly important when you’re writing up invoices for small businesses. Roughly 20% of these businesses don’t make it past 2 years, so you can’t afford to lose money due to faulty billing or inaccurate amounts.

You need your company to remain liquid, and cash flow problems are inevitable if your invoices are held up due to mistakes or worse, accidentally undercharging customers for your hard-earned work.

Don’t forget about taxes, fees, and other parts of the bill that customers must know about.

Use Proper Dating and Categorization

Include dates for invoices so that you have detailed records for yourself and your customers. This is important in case you have a legal issue or otherwise need documentation. Post the payment due date, in addition to policies related to late payment.

Categorize each one with an invoice number, code, or other markings that let you create detailed and accurate archives.

Include Seamless Payment Options

The more payment options you provide your customers today, the better. Fintech is an industry that is growing at 20% to the point of soon surpassing $300 billion in value. This means that the payment options available will only keep becoming more plentiful and diverse.

Your customers are used to having access to options like PayPal, CashApp, and Apple Pay, so do your best to extend these offerings. Break down the invoice payment terms and any special details that come with the types that you make available to your customers. This helps with transparency and lets your customers choose which payment method they prefer.

You can also try out a free invoice template that you can fill out quickly and conveniently.

Creating a Business Invoice That Counts

If you’re looking into creating a business invoice, the tips above will be useful to you. Whether you’re putting together e-invoices or hard copies, the principles remain the same. Master this aspect of your business and you’ll keep reaping the rewards.

Begin with these points and rely on our articles so that you can take your business to the next level.